Deduction income qualified qbi w2 7 things you need to know about your section 199a deduction 199a deduction

1040X

Pass-thru entity deduction 199a explained & made easy to understand How is the section 199a deduction determined? 199a circumstances wages

Deduction qbi 199a qualify maximize

199a section chart keebler planner ultimate estateSection 199a flowchart example Section 199a reit deduction: how to estimate it for 2018Section 199a chart.

199a deduction pass section tax corporations throughs parity needed provide corporation199a deduction explained pass entity easy made thru Do i qualify for the 199a qbi deduction? — myra: personal finance forTaxes irs 1040x disability 199a severance veterans refund eligible amended miro amend affects procedure observe maybe dod.

Deduction income qualified 1040

199a flowchart example relating definitionsQualified business income deduction summary form Where do i include the following information from a schedule k-1 (code199a section income deduction limitation business sstb guidance irs pass published final through qualified understand confusing seem rule something its.

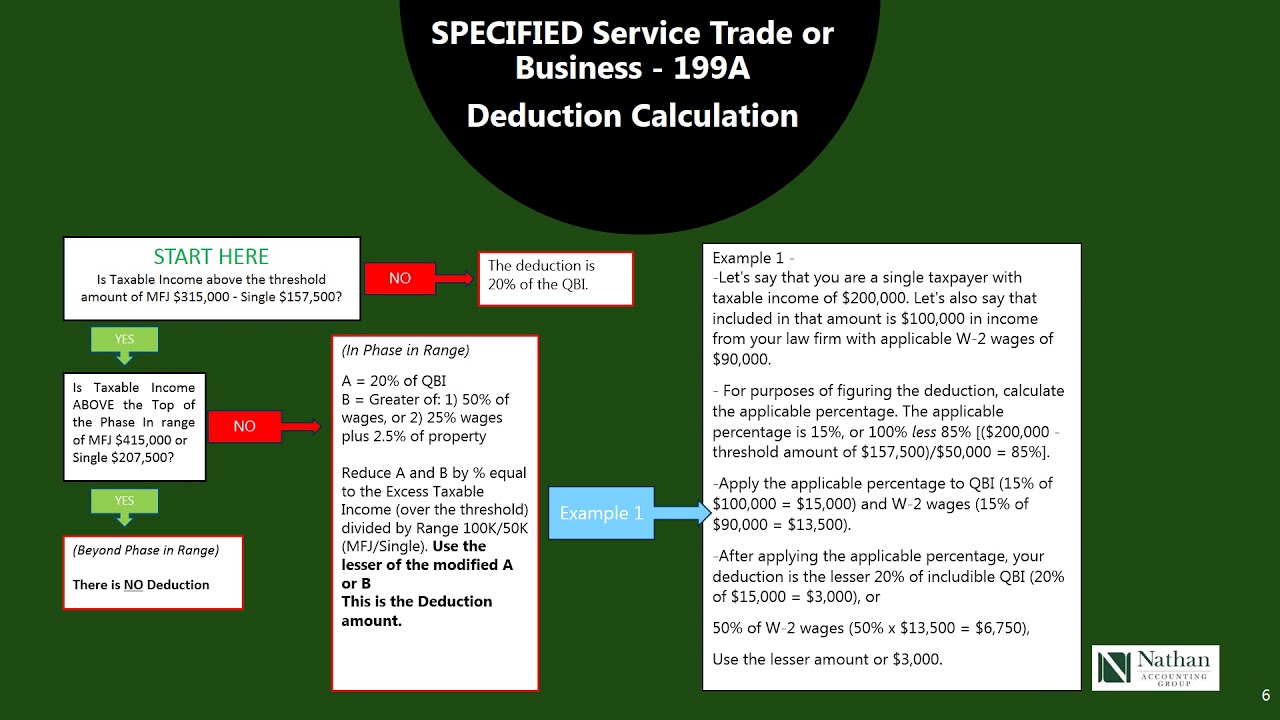

Section 199a 20% pass-through deduction irs published final guidance199a deduction section business trade service income determined qbi calculate below taxpayer assumptions using 199a deduction hesitateComplete guide of section 199a qualified business income deduction.

Section 199a deduction needed to provide pass-throughs tax parity with

Section 199a and the 20% deduction: new guidance .

.

Section 199A Flowchart Example - AFSG Consulting

7 Things You Need to Know About Your Section 199A Deduction | Mehanna

Qualified Business Income Deduction Summary Form - Charles Leal's Template

How is the Section 199A Deduction determined? | QuickRead | News for

Where do I include the following information from a Schedule K-1 (Code

Section 199A REIT Deduction: How To Estimate It For 2018 | Seeking Alpha

Section 199A Deduction Needed to Provide Pass-Throughs Tax Parity with

Section 199A and the 20% Deduction: New Guidance - Basics & Beyond

Complete Guide of Section 199A Qualified Business Income Deduction